What makes investing in Australian Agribusiness a sound choice?

What is Agribusiness?

The supply of food and fibre to the world through the group of industries dealing with agricultural produce and services required in farming and livestock production, as well as the timber industry (for the purposes of this article, we will not be discussing the timber industry).

Agribusiness investment

Investing in agribusiness puts money into businesses that are engaged in the steps required to send agricultural goods to market. When we look at the supply chain, there are three main sectors that investors can engage in, within the industry:

The 3 Pillars of agribusiness

- Production & Supply

- Processing & Packaging

- Distribution & Consumption

| Of all the sectors in the Australian economy, Agribusiness was the sector with the strongest combination of playing most to Australia’s competitive advantages and being a sector producing what the world increasingly wants.

Deloitte - Where are the growth opportunities in Australian agriculture |

| The Australian Agribusiness Supply Chain |

Production & Supply

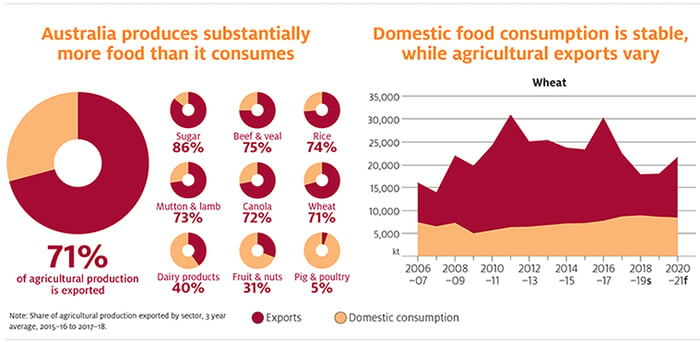

As a major food producer, Australia is one of the most food-secure nations in the world. Much of what we eat is homegrown, with imported food represents about 16% of household consumption.

Australian farmers have reaped the rewards of innovation and advanced manufacturing, enabling them to continue producing quality products even through a crisis, for example, crop farmers’ investment in time-saving machinery, much of which can be outsourced so smaller farmers sustains productivity. Australian farmers are world leaders in the invention and adoption of new technologies.

- In the management of livestock, innovative moves which improved paddock design have resulted in healthier more resilient stock; safe and efficient means of transport maintain animal quality.

- In cropping, very few of the conventional farming methods remain. Farming Innovation has delivered state of the art mechanisation for soil improvement, planting and harvesting, and reduced reliance on labour resources.

The result of wise innovation in the processing scenario encourages investment. The chicken meat industry is a case in point where innovation has been significant. Chickens which were traditionally raised in large sheds ran the risk of disease because of housing conditions – a critical components in the production of chicken meat being hygienic. Innovation in this industry has been significant. Now, automated, air conditioned, controlled conditions with sophisticated disease management covering all critical areas has been a game changer for investors.

In line with consumer demands, organic evolution into a self-sufficient industry and a “no waste mentality” sees most farmers utilising chicken manure to generate power and run sheds.

Processing & Packaging

The second stage of the paddock to plate journey relies on the processing and packaging and delivery of produce. Generally, this phase is more labour intensive than production. Some labour dependence is being reduced by mechanisation and sophisticated technology e.g optic machines which identify flawed/imperfect stock at a much greater rate than by human eye.

The labour and capital components are the big-ticket items, so machinery which is labour-saving and reduces human error improving quality control is highly valuable when a crisis comes along, and labour is in short supply.

During the recent crisis, there was little interruption to processing, though the closure of some abattoirs in Victoria disrupted supply for a time.

Paper packaging, which is predominantly sourced in Australia, meant that this stage in the process was unaffected, but plastics, predominantly from China were in short supply.

The absence of toilet paper-was not a production deficit but a combination of greed from bulk-buying and supply chain issues when processors were unable to bring forward the production lines. The pandemic has been a salutary reminder that processors must continue to review supply chains and anticipate logistical obstacles to build resilience to any future calamities.

|

Interruptions to the supply chain

|

In this reflective time, it’s worth acknowledging that the growth of fraudulent trade has put immense pressure on how our IT systems can keep ahead of criminal activity within agri-trade. For example, milk powder tampering in China which reduces the quality of Australian products and reputation. Adulterated wine and milk powder are just two examples of overseas interference. There is now technology applied at the processing stage which allows cotton tracing, so the provenance of materials is easily identifiable. The benefits from processing innovations are across the board and as applicable to the farmer as the processor.

In terms of processing the “no waste mentality” is widespread amongst processors with consideration being given to maximise the use of whole products, means not only more cost-effective operations but an industry that is highly responsive to current environmental and ethical trends. Power and water are necessary but expensive resources, so industries are looking to minimise expense in an environmentally friendly economically responsible way.

The industry is starting to tick some of the boxes that investors are calling for – accountability, responsibility and low carbon or carbon neutral investments which are realistic.

Distribution & Consumption

Australia has continued to maintain its agricultural supply chain and export with little impediment from COVID. World trade through international trade agreements has fortunately continued with trade routes open.

Biosecurity has not been compromised by a system where the produce is predominantly contact free - handled by machinery. In fact, it would take some major crisis or disaster like an oil shortage, something beyond the pandemic, to impact that process and stop sea freight.

Political decision making is probably a more likely risk as witnessed when certain governments reject freight consignments.

| Four key points of risk have been identified in Australia’s export supply chain during the COVID-19 pandemic. Currently, all four elements are either not considered to be impeding Australia’s trade position or have been the focus of direct government and industry responses to ease constraints. | |||

| Logistics & Freight The ability to get product out of the country is a strong determinant of Australia’s ability to trade. |

International Processors Labour availability in overseas markets may slow demand for Australian exports. Textile processors have been observed to have closed through the pandemic progression. |

Access to Labour Some sectors rely on migrant labour for harvesting produce. Domestic and international travel restrictions may affect some industries to produce and harvest. |

Government Service Delivery Continued certification, accreditation, and other regulatory services by Australian governments and our trading partners, which often require on-site audits before exports can proceed. |

| Read Government & Industry responses - Australian Agricultural Trade and the Covid-19 Pandemic | |||

Fortunately for Agribusiness, it has proven its resilience in continuing to trade through this pandemic. This is not only a feather in the cap for the industry but will make it attractive to a variety of investors. While some might only be interested in ‘pre-farm gate’ and only invest in production, others will invest in the entire supply chain to a certain country and will want to have control of all the components to get it to its destination.

Consumption

With Australia being a major food producer, a global crisis has little effect on the domestic consumers’ ability to access food staples. Only exotic, imported or niche products would potentially be in short supply, as they were in 2020.

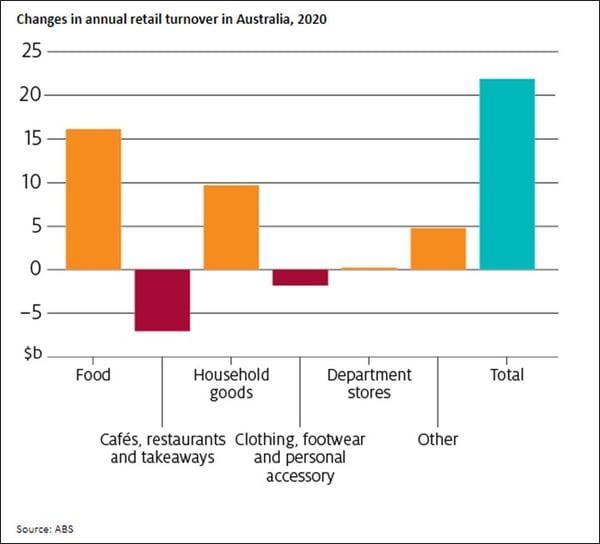

Due to hospitality industry lockdowns, consumer habits have changed, resulting in an increase in overall spend on food for preparation and consuming at home, opposed to previously spent eating out

Internationally, many places which are unable to produce their own grain, fruit, vegetables have become reliant on Australia for clean, green food.

|

Addressing the pain points

|

In Conclusion

There are diverse investors with different interests, but Agribusiness investment, as we have shown, stands alone in being a viable investment option, even during a crisis.

Agribusiness expert, John Storie, has unparalleled experience in the beef cattle, cotton and grain industries, having worked across most agricultural, pastoral and horticultural commerce. A veteran Agribusiness and finance consultant, his specialist areas include Agribusiness asset acquisition and management, corporate and non-corporate finance restructuring, risk management commodity marketing, trading and more.

Further Reading

- Australia’s place in global agriculture and food value chains

- Snapshot of Australian Agriculture 2021

- Australian Agricultural overview: June quarter 2021

References

Leave us your details to receive future information and tips on Warehousing: