ESG - why influence on the Mining sector continues to increase?

ESG and decarbonisation are the top two risk factors for mining executives in 2022 |

The rapidly changing and growing importance of ESG (Environment Social and Governance) is having a fundamental impact on business and investment decisions across the global economy, and none more so than the mining industry and resources sectors.

As an extractive industry, mining companies by their very nature are conscious of environmental and social impact. This social responsibility can however be at odds with the challenges of being a capital intensive industry that is exposed to commodity cycle volatility and a range of risks. As a result, ESG factors may not always command or retain the focus, or the priority required by triple bottom line sustainability.

Whilst there have been some high-profile ESG failures that have captured headlines, the mining industry often demonstrates leadership in many areas of corporate governance responsibility. An achievement that is often not recognised.

As investor and shareholder attitudes and demands towards sustainability financing place increasing value on ESG – operations sustainability factors are gaining far more weight in decision making, with business cases and investment decisions now being driven by growing demand for visibility on ESG performance.

This increased scrutiny on ESG is also playing out in mining sector, which also needs to rise to the challenge of meeting the worlds insatiable appetite for metals and minerals, and the exponential increase in demand for future facing critical minerals required to support the energy transition to a low carbon future.

This will require innovation and adoption of new mining technology and processes in a mines operating model, to find, extract, process and transport products from new geographies and jurisdictions presenting a range of further risks and opportunities around ESG.

|

The flow of capital to ESG investments has been enormous, with more than $35 trillion globally now in ESG assets – this is a huge pool of capital that cannot be ignored by mining and resources companies. |

ESG is now a major consideration in the financing of mining projects and invariably mining companies must now provide a range of ESG and sustainability criteria to meet bankability requirements (i.e. secure project financing). This is set to increase further with the pools of capital available from ESG funds growing. they will become a major potential source of financing in the future, placing further emphasis on the importance of a sustainable operating model in determining whether a mining project attracts and secures funding. It’s not just investors and financiers who are demanding more attention towards sustainability. Customers of consumer products and end users of extracted products and raw materials are now seeking to understand the ESG profile of a products supply chain, and especially the amount of greenhouse gas (GHG) emissions associated with the supply chain value chain of a product. |

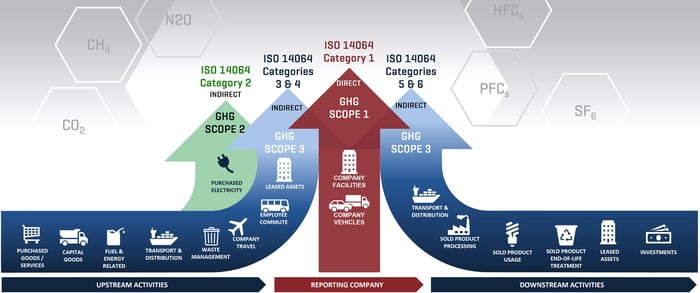

For companies operating in an industry like mining that produces raw materials used in downstream processing or manufacturing – reaching sustainability goals with the exposure to scope 3 emissions can be significant - and thus the relationship with the purchasers of these raw materials goes beyond traditional quality and price.

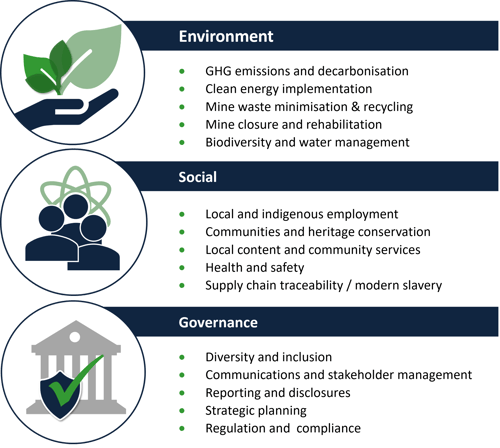

Key ESG considerations for the mining sector

The influence of ESG and sustainability on the mining and resources industry continues to increase and the risk profile of ESG at both a corporate and project level has never been higher.

With the rise in GHG reporting, the ‘E’ in ESG is increasingly dominated by tackling greenhouse gas emissions with wide spread corporate commitments to achieving net zero targets in the coming decades.

With the mining sector being such a carbon intensive industry, delivering on these ambitious targets in corporate governance will be challenging.

Companies are being pressured to address:

- their carbon footprint, both direct and indirect greenhouse gas emissions, and

- reduce emissions, avoiding and/or develop a plan to address unavoidable emissions (for example, via the use of carbon offsets that enable companies, as a minimum, to put a price on their carbon emissions.)

- minimise mine waste, recycle and rehabilitate

The sphere of ESG continues to evolve and every project or business has a different level of exposure.

Understanding this has never been more important, with stakeholders demanding more accountability and transparency from those responsible for the sustainable development of the world’s mineral resources.

Read more by Siecap:

Siecap ServicesSiecap provides a range of services to help ensure your business is positioned for the opportunities (and risks) presented by the growing demands of ‘ESG’ Carbon Assessment and Inventory Services | ESG Assessments and Planning Project Development Services | Study Management | Project Assurance | Grants and Funding | Supply Chain and Logistics consulting |

Resources:

- https://russellinvestments.com/au/blog/esg-mining-companies

- https://www.whitecase.com/publications/insight/mining-metals-2021/taking-esg-seriously

- https://www.theassay.com/articles/in-discussion/how-does-mining-get-on-the-radar-of-esg-investors/

Leave us your details to receive future information on Siecap services: