Project Contingency Management

What is Project Contingency Management?

Forming part of the project planning process, contingency is an estimated reserve that provides an organisation the ability to manage the potential negative impact of risk.

It is also crucial that the effective management of this reserve be a key element within any organisation’s risk management plan.

What is Project Contingency Management?

|

An effective project contingency plan and the process of managing contingency is central to the protection of value. Considering the maturity of the Project Management knowledge area and modern project management tools, it should be unnecessary to note that a contingency reserve should not be regarded as a substitute for proficient cost estimating or schedule development. |

ISO 31000:2018 states that “the purpose of risk management is the creation and protection of value. It improves performance, encourages innovation and supports the achievement of objectives”. |

But unfortunately a short literature search on the subject shows a leading cause of project failure around the world is attributed to incursion of extra cost with deviation from critical path resulting in significantly exceeding both budgets and schedules.

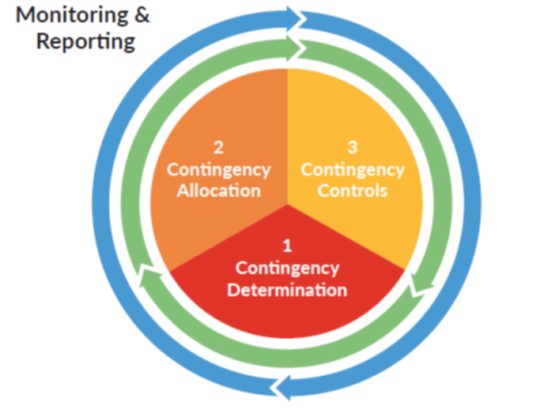

Determination, Allocation and Control

Determination, allocation and control of the contingency reserve (CR) (time and/or money) is a critical part of effective project risk management.

Contingency Management Framework

A carefully developed contingency management framework provides an organisation with a consistent methodology for range estimating and determining, allocating and controlling the contingency budget / reserve (cost and schedule) for all stages of a project’s lifecycle. This leads to better management of critical success factors, and overall project success.

Overall Process of a Contingency Management Framework

Contingency Determination

Both deterministic or probabilistic methods can be used to calculate a contingency reserve for a project. But whilst deterministic approaches are acceptable in the early stages of a project’s lifecycle, bottom‐up probabilistic methods of contingency determination, are always recommended where possible.

Deterministic approaches to contingency determination tend to focus on;

- mean or median situations, typically based on adding a predetermined “average” percentage of the project Base Estimate (e.g. 10%) to the project budget, or

- having a group of subject matter experts input into the mitigation plan on the amount or percentage to be added to each item or estimate.

There are times during portfolio management, when using these deterministic approaches can be considered reasonable i.e. in early stage projects, when there is a lack of data, when time is constrained, when similar projects or where similar risks occur and are being compared. But unfortunately these methods require judgements of uncertainty by the subject matter experts. Their cognitive biases and heuristic principles are vulnerable to getting things horribly wrong.

Probabilistic methods are a form of quantitative analysis which addresses uncertainty. These methods generally use Monte Carlo simulation which generates a very large sample of possible project outcomes and the frequency of occurrence of each.

Regardless of the method used, any integrated approach (cost and schedule), whether deterministic or probabilistic, should address the following five categories of risk:

- inherent risks associated with the cost estimating and scheduling methodologies

- inherent risks associated with the technical aspects of the system or project being developed, (i.e. systemic risks)

- contingent risks

- inherent risks in the correlation between Work Breakdown Structure elements or contingent risks, and

- specific risks for the project

|

Sam Savage, the author of “The Flaw of Averages” describes probabilistic analysis as; “Replacing a low-resolution “snapshot” of a single average number with a detailed “movie.” The movie comprises a whole range of possible values and their likelihood of occurring—the frequency distribution”. |

Inherent Risk

Inherent risk is easily explained as the inability to be absolutely certain about elements of the project, specifically cost and duration. While the probability of occurrence of inherent risk is 100%, much of what drives the level of this risk is fairly common amongst industries, projects and organisations e.g:

- degree of scope and engineering definition,

- the dynamics of the project team,

- influence of external stakeholders, and

- contracting methodologies etc.

Contingent Risk

Contingent risks are generally caused by external events and are largely the risks arising from the interface of the project with outside systems and as such these are usually listed in the project’s risk register.

The probability of occurrence of contingent risk is never certain and is always less than 100%.

Examples of contingent risks;

- are delays or cost increases due to bad weather,

- accidents and other unforeseen incidents,

- environmental incidents,

- social issues,

- industrial action,

- planning approvals,

- scope variations,

- unexpected site geotechnical conditions

Contingency Allocation

It’s common practice to distribute the determined contingency equally across all work packages. On this basis, if the overall contingency funds are 20% of the total base estimate, each work package would receive a notional 20% contingency budget.

This practice remains fundamentally flawed, leaving some low risk packages or elements overfunded and the packages or elements that contain the most risk or exposure, severely underfunded and vulnerable.

The preferred means of allocating contingency should be on the basis of each package or element’s vulnerability or exposure to risk, thereby providing all packages or elements with the correct level of contingency reserve.

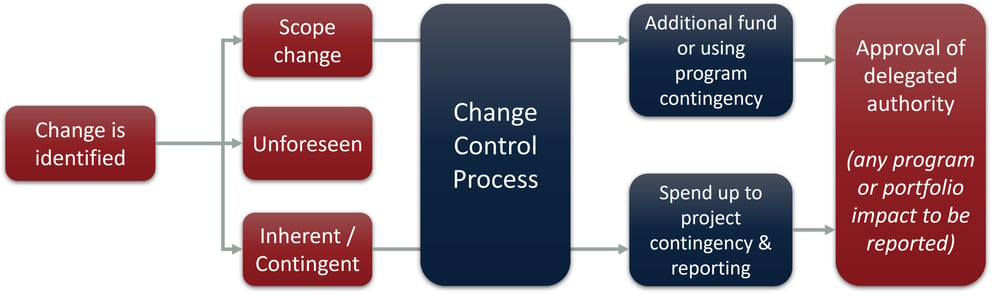

Contingency Control

The key objective of contingency control is cost management of the contingency reserve. Effective governance should be implemented to ensure that managing contingency spend remains within approved limits for its intended purpose.

Change control is a core part of effective contingency control. Contingency reserves should not be released without being reviewed in some sort of change control process, typically forming part of good fundamental project management systems. Risks and issues that occur should be reviewed to confirm that it is covered under contingency and is addressing threats or opportunities within the project.

Contingency Control Process

The regular and consistent reassessment of contingency requirements and performance throughout the project lifecycle provides consistent and transparent disclosure of managing contingency across all levels of governance.

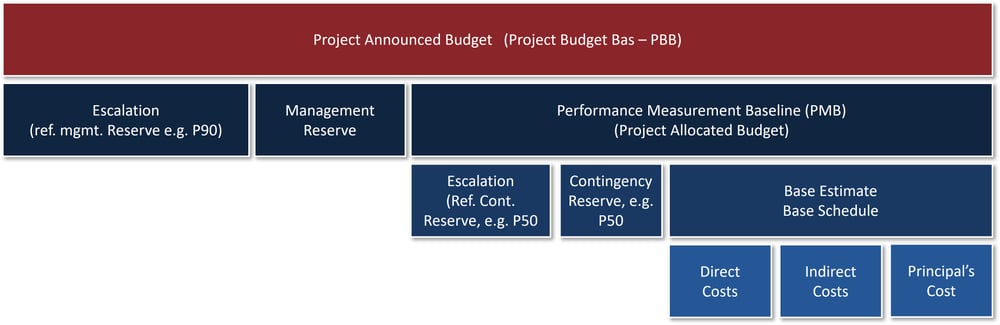

Management Reserve (MR)

The Contingency discussed in the article to this point relates primarily to a reserve added to the cost baseline against identified risks or sometimes “known-unknowns”.

The management reserve on the other hand is an amount withheld for management control purposes. It is a planned amount, time or resource which is added to an estimate for unforeseeable situations also referred to as “unknown unknowns”.

It is also important to note that the management reserve is not used for scope changes by the customer. The topic of the management reserve is covered in more detail within the project management guide to Earned Value Management.

|

PMI’s guide to project management defines the management reserve as: “An amount of the project budget or project schedule held outside of the performance measurement baseline (PMB) for management control purposes that is reserved for unforeseen work that is within scope of the project.” |

Components of the Project Budget

A typical scenario with regards to the determination of both the contingency reserve (CR) and management reserve (MR) is where a probabilistic analysis indicates a P50 of say $10m and a P70 of $20m. The decision is then taken to allocate the P50 contingency ($10m) as the CR, and the remaining $10m, i.e. P70 minus P50 contingency, as the MR.

It is important to note that the control and management of the MR remains firmly with the Project Steering committee or Project/Programme Director.

Conclusion

This article provides an overview of the topic of contingency management only, should you require any further information, clarification, or assistance with regards to risk and contingency management, please let us know you requirements below:

Related Articles

References:

- A Guide to the Project Management Body of Knowledge (PMBOK® Guide)

- Risk Engineering Society (RES) - Contingency Guideline - Revision: 2.0; Release date: February 2019,

- Sam L. Savage, the author of “The Flaw of Averages, pub.2012