How is China’s zero-COVID policy impacting APEC supply chains?

|

“A resilient supply chain is as much about being able to fight recovery battles in the here and now, as about being able to secure a strategic advantage in times of crisis that competitors won’t have the ability to replicate.” |

|

“There is no denying that we are living in volatile and uncertain times. As most of the world appeared to be over COVID, started opening up and learning to live with COVID, China went into lockdown. This, against the backdrop of higher inflation and rising costs, is putting pressure on businesses across the board, especially supply chains and industrial markets.” Tim Armstrong |

Tim Armstrong, Global Head of Occupier Strategy and Solutions at Knight Frank, put the following questions to a panel of cross industry supply chain professionals:

- How are the lockdowns in China affecting supply chains?

- What is required of companies to adapt and build reliance in their supply chains?

- How are Organisations managing inventory in uncertain times?

- What the impact is on industrial markets? and

- Which industrial markets stand to benefit as a result of these moving dynamics?

How can companies best manage their supply chain resilience together?

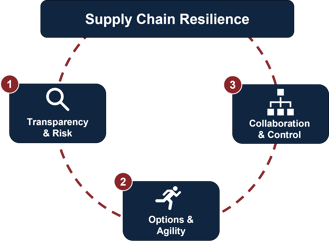

To unpack resilience, we must start by framing what resilience means and how it relates to recovery in a supply chain sense.

However, operational recovery alone does not provide for a long-term solution and indeed may not always be effective in terms of service or cost. This is where the strategic pillar ‘resilience’ comes into play.

|

Recovery is about acting quickly to respond to the effects of supply disruptions.

Supply chain recovery may include:

|

|

Good strategy equals good executable options when you need them. The Pandemic, Russia-Ukraine conflict and the more recent China lockdowns have all elevated and added a sense of immediate urgency to these elements. Over the last few years, most of our clients have redefined risk and reassessed the potential risk exposure within their supply chains regarding geopolitical, modern slavery and supply risk. |

Resilience is about developing strategic and executable contingency plans. These plans would be identified through framing potential scenarios, which are then used to develop effective countermeasures to mitigate the risks that can threaten an organisation. |

|

Covid has accelerated this issue, but this trend was happening pre-Covid many organisations had reframed risk in the APEC region, particularly in the wake of geo-political uncertainty. The danger of over reliance on a single-source supplier or country has been exposed. |

|

How can companies best manage their supply chain resilience together?

Given the risk-based approach, local organisations are looking to onshore what they can or buffer more inventory to manage the inconsistencies in supply from offshore locations related to shipping costs and lead times.

We are seeing a more strategic and redefined risk-based approach to inventory where more inventory is held across the supply chain network due to the supply variances that are killing performance to end customers. This however has not been a perfect solution, as the mix of inventory held is out of alignment with the general demand requirements.

This may change, as during the pandemic the cost of capital was obviously at historic lows, as this rises in the months to come, we will probably see some structure policy changes from clients.

Do you believe the changes made to supply chains because of Covid are long-term structural changes or will we return to a pre-pandemic way of doing things?

|

With the re-definition of supply chain risk, the need for better visibility and optionality, alternate sourcing regions, near shoring or onshoring will be a trend over the next decade. |

We believe that the changes that have been made to supply chains because of Covid are generally structural, “the train has left the station”, development is underway, and time will tell if, from a cost standpoint it can be sustained. People have also learnt that China got very good at manufacturing which won't happen overnight for other jurisdictions, so there has been extensive investment in attempting to get the game plan right. |

Do you see any major changes to the way industrial facilities will be built in the future?

Changes will need to be made in the building and utilisation of industrial facilities, for a number of reasons:

- Ecommerce needs scale and agility to support sales events, small order profiles and fast turnaround times, more automation to meet spikes, and speed will mean distribution points closer to the market, so we will need to leverage existing brownfield sites closer to deliver the experience to customers that they desire.

- Organisations fundamentally offshored to lower-cost nations (like China) due to local high labour costs and with further changes in the minimum wage in Australia, will potentially see more and more investment in automation.

- With land premiums increasing buildings will become more vertical in nature.

- Building also needs to consider, power, Geotech, and super flat flooring for automation scope, even if it is not planned for today, it should be an option for installation in the future.

- Environmentally, green/embodied carbon building will become a non-negotiable option. Even if an organisation does not have a mandate now, it will in the future, so this needs to be planned for.

| What will a future of decarbonised and electrified logistics need to look like for a modern facility? |

Do you see any disruptive trends that we are seeing in the market?

Aside from massive trends that e-commerce and resilience are having right now, and while no one has a crystal ball the following big trend focus’ over the next decade are set to change the way supply chains must operate:

|

Supply Chain Assurance and Modern Slavery will demand supply chain visibility, compliance, risk management and mitigation, which will be a constant and ever evolving focus. |

|

Digitisation and Automation will need to be implemented. Not only mechanical, but big data, blockchain, AI and process automation to improve visibility, speed, accuracy, security, and decision making. |

|

Decarbonisation of the Supply Chain. Carbon Inventory and understanding the carbon emissions within the various scopes of an organisation's supply chain will be crucial in making decisions on carbon emissions reduction and commitments to meet net-zero requirements. Scope 3 emissions make most of any organisation’s footprint so it will be an imperative to unpack and measure. Developing reduction strategies across also scopes and new energy sources will be a continuing focus. |

We are seeing a reasonably urgent approach to climate capital with a high emphasis on critical minerals and alternate energy sources being required due to net-zero commitments which are heightened by the current energy price that will impact on supply chains across the world.

- Siecap is currently working on critical minerals and hydrogen development pilot projects [Read the Case study]

- View Siecap's Carbon Inventory Services

- View the full Knight Frank webinar

Leave us your details to receive future information Supply Chain News: