“The rise of ecommerce has not only changed the game in terms customer experience and expectations, but it has been a catalyst for other industries to refresh their thinking on how they can add more value by increasing service, speed and agility.”

-David Irvine, MD, Siecap

Australian online shopping industry growth surged a historic 60 per cent year over year in 2020 to reach A$32.7 billion in ecommerce sales. At 9.4 per cent of the total retail industry spend, Australia is roughly a decade behind its overseas counterparts, such as the United Kingdom, in its adoption of online shopping. The pandemic has forced a permanent shift in the way Australian shoppers think about ecommerce, lighting the fuse for an era of explosive growth.

Australia typically lags in its adoption of consumer trends when compared to its overseas counterparts. This has been seen in the take up of e-commerce in Australia. The barriers to entry have been largely overcome, spurred on by COVID-19 lockdowns and restrictions which temporarily closed brick and mortar stores. This forced industry operators to adapt within the competitive landscape, by an intensification of digital marketing, a central focus on customer experience, same-day or next-day delivery, and the integration of buy now pay later platforms. These pillars are paving the way for Australian ecommerce as a legitimate new channel to retail.

Australians are highly digitally proficient and demonstrate strong enthusiasm towards overseas trends. For the first time in years, COVID-19 forced consumers to alter their way of thinking about online shopping and ultimately adjust their behaviours.

The purpose of this paper is to discuss:

- Why e-commerce will keep growing in Australia

- The magnitude of growth organisations should expect?

- The trends organisations must be aware of to profit from online growth, including:

- Customer expectations, and

- The role of data analytics, technology and automation in servicing explosive demand and escalating service levels.

Why Ecommerce will keep growing in Australia

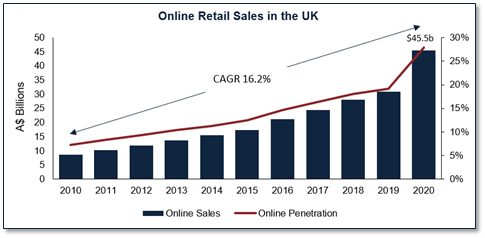

Ecommerce in Australia is yet to reach saturation point. Online sales in the US grew from A$210 billion in 2010 to A$1.1 trillion in 2020, equivalent to 15.9 per cent growth per annum. This was achieved in the context of a relatively low, stable population growth of 0.6 per cent. During the same period, online sales in the United Kingdom increased from A$8.7 billion to A$45.5 billion in 2020, reflecting average growth of a rapid 16.2 per cent per year.

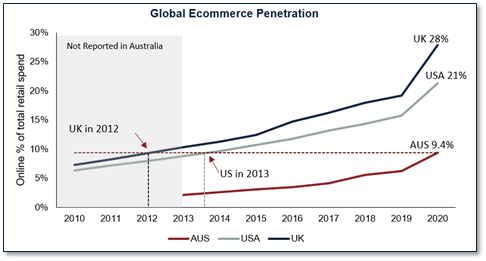

Our current penetration rate of around 9 per cent mirrors the US in 2013 and the UK in 2012, which have since soared to 21 per cent and 28 per cent respectively. The same boom seen overseas is expected to be replicated in Australia, supported by higher population growth, enthusiasm towards international trade and overseas trends, and large investments in transport and infrastructure. Industrial real estate is anticipated to benefit from increased ecommerce penetration, particularly in areas of high population density.

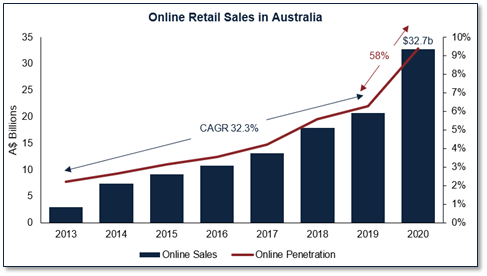

Australia has already begun closing the gap. Online sales in Australia enjoyed an average annual growth of 32 per cent in the six years leading up to 2019, before spiking a significant 60 per cent to reach $32.7 billion in 2020 due to the COVID-19 lockdowns, smashing all previous forecasts. The online share of retail sales peaked at 10.1 per cent in February 2020 and averaged 9.4 per cent across the year, up from 6.3 per cent in 2019 and 5.6 per cent in 2018. The gain of over three percentage points in 2020 is by far the largest spike in online penetration since it has been reported by the Australian Bureau of Statistics (ABS).

The share of online non-food sales was higher in its sector at 15.2 per cent and online food sales lower at 4.6 per cent, demonstrating the logistical challenges associated with handling and delivering food products. Regardless, online sales in both sectors have steadily risen since 2016 and remain elevated after peaking in early 2020.

Analysis by Australia Post is even more optimistic, finding that A$50.4 billion was spent online in 2020, up 57 per cent year on year and equal to 16.3 per cent of the total retail spend. The ABS noted in its online data release that retailers had to adapt sales channels very quickly during the pandemic and that the value of online purchases may be underreported as a result. Total retail sales were accurately reported, suggesting that the actual penetration of ecommerce may be closer to Australia Post’s 16.3 per cent figure.

“There’s been a great acceptance of online shopping. I think about a decade’s worth of retail trends have been brought forward. In this next 12-to-18-month period, we’re going to see consumers embracing online in a big way.”

–Paul Zahara, CEO of the Australian Retailers Association in October 2020

How much growth should we expect?

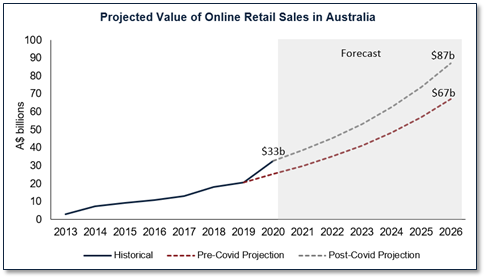

Australia Post predicts that by 2025, online shopping will account for around 18 per cent of the total retail spend in Australia and reach a 22 per cent share by 2026. If the retail market returns to its pre-pandemic growth (2.4 per cent growth in the five years to 2019 according to the ABS), total retail sales could reach a huge $402 billion by 2026, up from $350 billion in 2020.

Therefore, Siecap expects online retail sales to reach between A$67 billion and A$87 billion by 2026, driven by solid retail growth combined with an accelerated acceptance of online shopping. This would represent growth of 166 per cent and almost three times the online sales achieved in 2020. There is potential for even further acceleration as pandemic-driven lockdowns persist in Australia’s major capital cities and traditional brick and mortar stores increase their online offering in a bid to survive.

This rapid online expansion will shape logistics supply chains and warehouse design in the coming years. There is limited land supply in key industrial suburbs, highlighting the need for e-retailers to automate supply chains and take advantage of vertical warehousing.

JLL and Colliers estimate that for every $1 billion increase in online sales, between 70,000 and 85,000 square metres of additional industrial warehouse space will be required. This equates to an additional 3.8 to 4.6 million square metres of industrial demand in Australia from ecommerce alone by 2026.

The trends your organisation needs to consider

“Our ecommerce Industry will get to where the others are, to the 20-30 per cent overall retail level that we see in the US, Germany or the UK. So that for me is the key focus.”

– Ruslan Kogan, Founder and CEO of Kogan.com in March 2021

As discussed earlier in this paper, pandemic-induced lockdowns drove a whole new segment of Australians to shop online for the first time, with most new shoppers indicating they will continue to shop online. As the ecommerce offering matures, Australian customers are becoming increasingly aware of the level of service that is possible. Business-to-consumer (B2C) experiences are driving business-to-business (B2B) expectations, with customers demanding a seamless experience across the entire ecommerce value chain.

Siecap has identified two key customer expectations that online retailers must be aware of in order to attract and maintain market share.

- Transparency and short delivery times

- Convenience, availability and range

This section will further detail these evolving expectations and discuss the role of technology in ensuring organisations can meet such demands. Specifically, Siecap has observed the trend of organisations turning to data analytics and automation to shorten cycle times and optimise their supply chains to profitably capture future growth.

Customer Expectations

Transparency and short delivery times

Established online retailers such as the Iconic are setting the baseline for customer expectations of delivery speed and transparency. According to the International Post Corporation, receiving a delivery on an exact day, defined at the purchase moment, is important to 68 per cent of consumers. Around one quarter of customers are prepared to pay for premium delivery services that reduce delivery times or offer specific time slots for the delivery to take place. Speed to market is increasingly being used as a marketing strategy, with next-day delivery helping to improve customer satisfaction and build brand loyalty. Customers are also demanding a closer interaction with the vendor after the payment stage of online shopping, including location tracking and updates on the delivery stage of their purchase.

“In a world where customers want everything delivered yesterday, you need to build a tomorrow that meets those needs. We’re starting with groceries delivered in 10 minutes, but this is just the beginning.”

– Matt Knapp, Head of Creative at MILKRUN

Convenience, Availability and Range

Not only are customer expectations and volumes purchased online increasing, but the scope of items purchased online is expanding. Customers now buy not only fashion, media and technology online, but groceries, bulky homewares, hardware and beyond. Homewares and appliances are now the largest ecommerce category in Australia at 33.4 per cent share of online purchases (IBISWorld, 2020). Online stores are increasingly becoming a one-stop shop for a wide range of products to provide the highest level of convenience, resulting in more diverse basket contents and greater logistics footprints. With convenience comes smaller basket sizes and increased return volumes, which is increasing processing costs.

“We see the significant benefits that next generation innovation brings in terms of enabling increased safety and productivity, enhancing customer service and improving flexibility to adjust to changing package volumes and sizes.”

– Ted Dengel, Managing Director of Operations Technology and Innovation at FedEx Ground

Many companies rapidly adapted their front-end ecommerce offering during the lockdown but struggled to transform their logistics models to support the growth in demand. In a market dominated by established online megaretailers like the Iconic and Amazon, online businesses must leverage data analytics, technology, and automation in their supply chains to better serve their customers to compete and remain relevant. Without technology, new e-retailers will fail to take full advantage of the opportunities in an era of explosive growth and disruption.

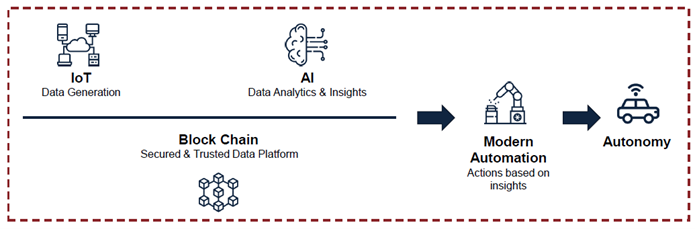

On the front-end, companies are now utilising advanced data analytics and artificial intelligence (AI) alongside consumer data to predict demand, promote sales events and adjust pricing. This informs decisions around product offering and inventory holdings and works in concert with devices connected via the Internet of Things (IoT) to automate tasks in the warehouse, as displayed in the figure below. The net effect of these innovations is a shorter cycle time and reduced potential for human error. These technologies are the pillars of modern automation and Industry 4.0.

Internet of Things

The Internet of Things refers to the network of physical devices that are digitally connected. The devices collect data and share information with one another via a giant network known as the IoT, and apply analytics to identify patterns, provide recommendations and detect potential issues before they occur (IBM, 2021). IoT devices often use sensors to measure data in the world around them, such as temperature, location, movement, and humidity. Manufacturers, for example, can use IoT cameras to identify defects and reject faulty products before they reach the market.

Industry 4.0

The fourth industrial revolution, known as Industry 4.0, is characterised by integrating the physical with the digital to increase automation in manufacturing supply chains. It is the network of machines that are digitally connected through the IoT that will allow supply chains to become more efficient and less wasteful. Computers communicate with one another to make decisions without human involvement and ultimately get smarter with greater access to data thanks to machine learning.

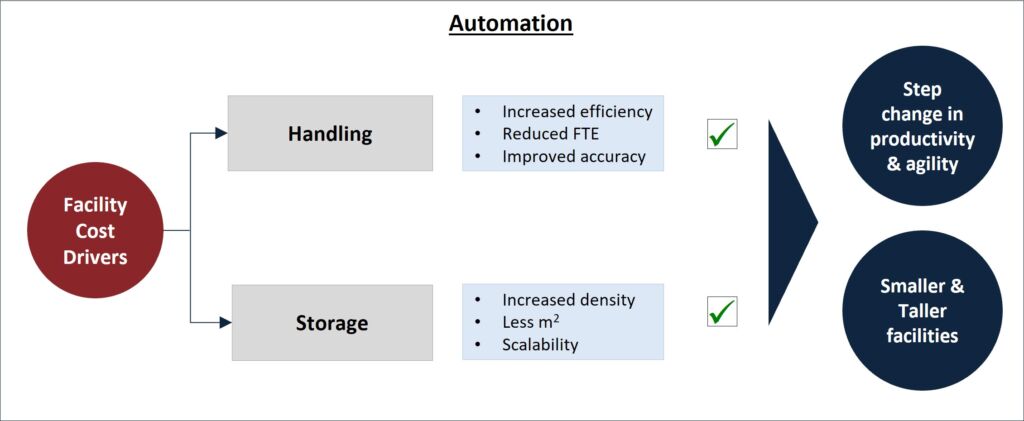

Specifically, the two typical major cost drivers in ecommerce warehouses are handling and storage. By automating handling processes, warehouses can increase efficiencies, reduce FTE, and improve accuracy. Automated processing means that warehouses can leverage greater density of layout and better scalability, boosting productivity and reducing costs associated with floorspace, labour wages and human error. Despite being an historically expensive exercise, new players, scalable options, lower capital costs and rising labour costs have rendered supply chain automation more attractive in recent years.

Ecommerce Facility Cost Drivers and Improvements from Automation

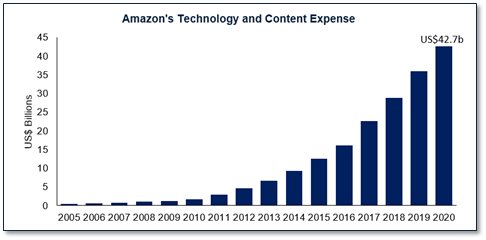

According to Amazon’s fourth quarter earnings release, the company spent US$42.7 billion on “technology and content” in 2020, up 19 per cent from 2019 and 242 per cent from five years earlier. Amazon does not report its research and development spend but defines its technology and content expense as including R&D costs, amongst others. Whilst the exact portion spent on R&D is unknown, the importance of investing in innovative technology to remain competitive is clear from the figure below.

“In the old world, you devoted 30 per cent of your time to building a great service and 70 per cent of your time to shouting about it. In the new world, that inverts.”

– Jeff Bezos, Amazon Founder

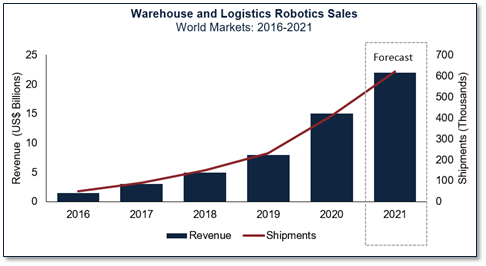

This is reflected by strong growth in global warehouse and logistics robotics sales, which have grown at a CAGR of roughly 58 per cent per year in the past five years and are forecast to reach US$22 billion in 2021. Integrating robotics and automated processes into supply chains brings a range of altered requirements for a building and is key to scaling ecommerce businesses.

Summary

There have been huge challenges for businesses around the world, but with crisis comes opportunity.

Siecap’s research has concluded that the Australian paradigm of thinking about retail has shifted permanently towards greater awareness, acceptance, and trust in online channels. The growth seen in 2020 will provide the baseline for the proliferation of online shopping in Australia in the coming years, with online sales predicted to reach A$67 to $87 billion and a 22 per cent penetration by 2026.

The key for organisations to capture this exponential growth is a customer-centric focus that provides a convenient online experience, short delivery times and a vast available product range. Retailers must invest in expanding their automation and analytics capabilities to lift the level of customer service in terms of speed and accuracy.

A full list of references used in this article are available in the downloadable version, which can be accessed here.

Please contact us any time to arrange a no obligations meeting and understand how Siecap can add value to your organisation’s logistics and supply chain processes.